Stonington Fundraising Outlook

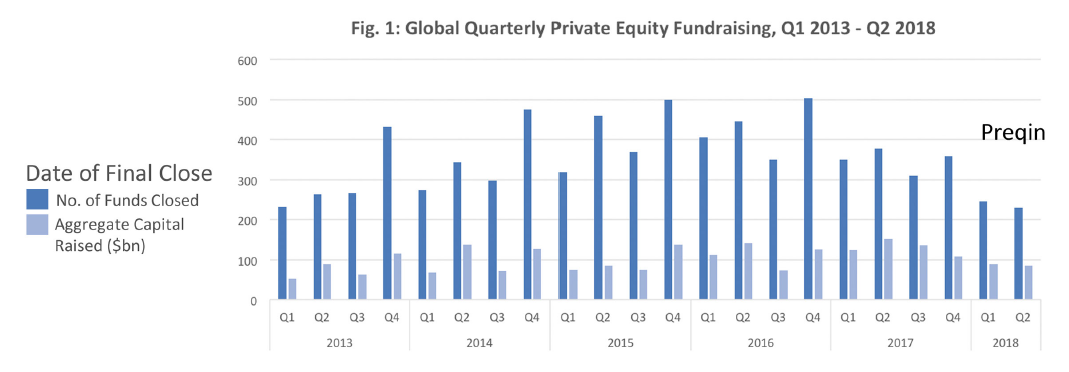

While 2018 continues to be a healthy fundraising environment by historical standards, Q2 saw another decline from previous years, in fact at $85 billion in capital committed, it is the slowest since 2012. Once again, much of this capital came to a disproportionately small number of large funds. Venture was similar to previous quarters with a total of $22 billion raised. One bright spot was the increased interest in growth-oriented funds, where fundraising activity increased from 5% to 14%. This was not a surprise to us as we have witnessed the continued demand for healthcare, technology, and consumer goods driven strategies. On the other hand, fund of funds capital raising for the second quarter dropped from $4.1 billion to $2.1 billion. As end investors in numerous lower middle market middle funds, this suggests that capital raising from those groups will become even more competitive if those statistics don’t turn dramatically in the second half.

On the limited partner side of the business, investors continue to have the strongest preference for buyout, a recent survey by Preqin suggesting that this category makes up 74% of institutional investors targeted private equity allocations. In line with the themes mentioned above a greater proportion of active investors have searches for venture and growth funds than recent years. That all said, the general theme of selectivity continues, as over 50% of investors plan to invest in 3 or fewer funds over the course of the quarter.

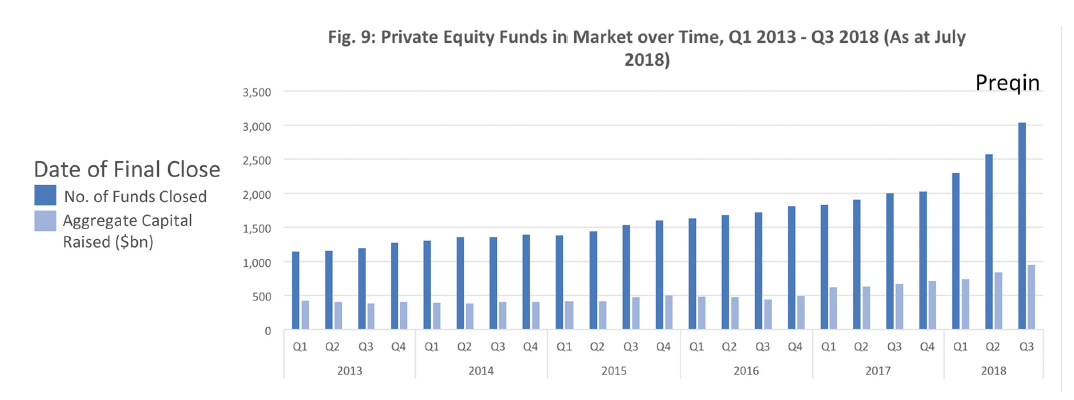

With respect to the fund manager side, the amount of product continues to mushroom with a record 3,037 funds in the market seeking an aggregate of nearly $100 billion at the start of Q3, which is a staggering 52% increase in the number of funds seeking capital over Q3 2017. Quite simply, the competition for capital has never been greater. While approximately half of these funds are investing in North America, there has been a massive increase in those investing in Asia. In fact, there were 985 such funds in the market which increased by 159% from the 380 at the same point last year. Finally, the 10 largest funds are seeking over $300 billion which is nearly a third of the entire private equity capital raising market.

For the smaller side of the middle market where Stonington raises the vast majority of its capital for, the two strongest themes that Stonington has observed is first the continued increase interest from lower middle market investors for co-investments in direct deals, and secondly investors previously noted appetite for growth strategies and portfolio companies with the largest areas of interest in healthcare and technology.

Co-investment has always been integral to investment programs at insurance companies and fund of funds, but the interest in direct deals is now so high that we would say it is now central to a significant number of lower middle market investors. As investment staffs have grown in size and sophistication, the ability to customize their bets on a manager through additional deal exposure has never been stronger. Beyond making bets on industries investors are comfortable with the added transparency to their total investment with a manager is also critical. This has also resulted in the continued blooming and maturation of the independent sponsor market where unfunded managers are able to access a growing capital source from investors not wanting to be burdened with a blind pool, which one of our articles below will discuss in more detail.

With a currently healthy economy and rising public equities market, investors continue to look to profit from growth-oriented strategies with the largest areas of focus being technology and healthcare, which area we also explored in a recent article in Mergers & Acquisitions attached below. Niche strategies also continue to be of interest, as investors search for growth and to “fill-in” around the edges of their core buyout portfolios. For this reason, we have witnessed a number of emerging managers find success in the fundraising market with highly specialized strategies.

In conclusion, while we continue to be in a healthy fundraising market, the competition has never been larger, and for that reason it is more important than ever to “stand-out from the crowd.” This means leading with you best foot forward with respect to your entire fundraising package and leveraging co-investment opportunities to make lasting long-term relationships. Stonington Capital Advisors is here to help you make that impact as strongly and efficiently as possible and we hope to speak soon.

“Under the Radar” Private Equity — Investor Demand Increases

– Justin Garrod

In a market with valuations at all-time highs, there is a greater desire among private equity LPs for sponsors who have an edge in sourcing opportunities in less competitive processes. Specialist private equity firms with “under the radar” or “niche” strategies can provide that edge, enabling them to deliver strong uncorrelated returns to investors. To name a few, niche strategies include, intellectual property, litigation claims, life insurance settlements, oil and gas, aircraft leasing. Ten years ago, firms with these strategies marketed exclusively to family offices and endowments. Today, institutions ranging from public pension plans, insurance companies and even fund of funds invest in these strategies and are increasing their allocations to them.

Litigation finance is an example of a niche strategy that has been developing into a recognized area of private equity with increased fundraising success. The litigation finance concept is for a firm to provide capital for all or a portion of a civil legal claim and in return, receive that portion of any proceeds recovered from a given litigation. The industry focuses on corporate claims ranging from intellectual property to breach of contracts matters. According to Pensions & Investments, the $460 million Aurora Colorado based General Employees Retirement Plan is expected to allocate 5% of its’ plan to corporate litigation finance. Earlier this year, litigation finance firm, Lake Whillans Capital received a $50 million commitment from the University of Michigan for its debut fund. Lake Whillans was founded by former Cleary Gottlieb litigator Boaz Weinstein and former Burford Capital executive Lee Drucker. Private equity and hedge funds have invested $30 billion in litigation finance up from $1 billion in 2011 according the Litigation Finance Journal. PE firms Burford Capital and IMF Bentham have had the most success raising capital for this strategy. As a sign of the times, Bill Strong the former head of Morgan Stanley’s Asia Pacific Region left Morgan Stanley, not for the expected large well-known private equity firm but for litigation finance firm Longford Capital.

Another such strategy that has received a great deal of recent attention from the LP community is music royalties. Institutional investor interest is not lost on music royalty industry professionals who find the private equity structure appealing. This industry has experienced considerable market growth impacted by the explosion of music streaming and the increasing number of social platforms that allow music embeds.

The asset class’s institutional birth is often cited as when in 2009 Dutch Fund ABP, the world’s third largest state pension fund, bought the Rogers & Hammerstein catalog of songs in a deal for approximately $200 million. Round Hill Music Royalty, a private equity firm dedicated to investing in music copyright assets announced earlier this year that it closed its second fund vehicle at $263 million. Round Hill was formed by Joshua Gruss, Richard Rowe and Neil Gillis and raised its second fund after closing on $193 million for its first fund two years earlier. Other names in this space include London based Kobalt Capital and Bicycle Music. While the family office community has been investing in this area for some time now, large institutions like Ontario Teachers’ Pension Fund have allocated significant capital to this strategy. Kobalt Capital recently announced it had raised a $345 million fund. The lead investors of this fund include a large UK Pension Fund, RPMI Railpen amongst other prominent LPs. While Kobalt’s first fund was smaller sized fund, but with the utilization of debt invested $350 million worth of copyright assets. The second fund will provide Kobalt with $600 million of buying capacity given the debt it is able to procure. Kobalt Capital is a subsidiary of the established Kobalt Music Publishing Company, a company that has experienced average revenue growth of 40% over the past decade and also received a significant equity investment from Google.

The Independent Sponsor Arrives

– Ed Eiland

The independent sponsor market continues to mature and gain traction with capital providers. Over the past 2-3 years, Stonington Capital Advisors has seen a groundswell of interest from institutional investors for direct deals. In parallel, successful CEO’s, private equity executives and private equity operating partners continue to leave their established firms in search of greater autonomy and better economics as an independent sponsor. What is the future of the independent sponsor model?

An independent sponsor is similar to a private equity fund, with the exception that it does not have capital committed from limited partners in a pooled fund. The independent sponsor combines the rigor, sophistication and approach of a traditional private equity firm, but maintains the flexibility and autonomy of operating without the mandates to deploy committed LP capital. The most successful independent sponsors focus on institutional quality deal sourcing, transaction execution, portfolio company monitoring and often invest personal funds along-side other investors.

Stonington has advised former executives of Pepsico, Apollo, Oakhill and numerous other operating partners on raising transaction capital. Transactions tend to be proprietary to lightly auctioned where the executive has a deep relationship and ability to add value to the transaction. Institutional capital for direct deals is flowing in from family offices, insurance companies, endowments and foundations and fund of funds with co-invest/direct investment mandates. These investors want discretion, lower fees and to move away from the 2/20 private equity model. In addition, traditional private equity funds seeking to boost their capital deployment are increasingly teaming up with independent sponsors.

Typical economics to sponsors includes a closing fee, annual management, monitoring fee and a promote/carried interest. Closing fees range from 1% to 5% of enterprise value, however, depending on the investor base, this fee may be rolled into the sponsor’s equity investment in the portfolio company. Annual management fees range from 3% to 5% of EBITDA or straight dollar amounts ranging from $100,000 to $400,000. Promote/carried interest ranges from a 20% carry, for proven sponsors, to a 10% carry above 1x or 8% preferred return, often with second-tier carry of 20% – 25% above a 2.5 – 3x preferred return to further incentivize stellar performance, in each case benefiting from a catch-up provision.

With an abundance of cash waiting to be put to work in today’s market, the greatest assets of the independent sponsors are their deal-sourcing ability and specific industry experience. The ability to originate value add investment opportunities is the most critical component to independent sponsor success. Stonington recently worked with a former hospital executive, turned private equity operating partner and now an independent sponsor who had won a healthcare deal in a very limited process over a well-established private equity firm based on his extensive industry experience and personal relationship with the seller. Personal relationships can go a long way in closing a transaction.

Anecdotally, many of Stonington’s successful independent sponsors are finding deals at lower multiples, in the range of 4-6x EBITDA with very limited processes (even proprietary). In contrast, according to the Pitchbook 2017 annual report, the median enterprise value to EBITDA multiple was 10.4x. Attractive valuations coupled with experienced independent sponsors can significantly enhance economics for the independent sponsor.

We fully expect that the independent sponsor space will continue to grow in popularity and acceptance, with more sponsor entrants and greater numbers of companies and capital providers embracing independent sponsor transactions. We also expect further standardization of terms and practices through technology platforms as the sector continues to mature. Stonington continues to create an dynamic ecosystem between GPs and LPs to deliver increased efficiency, security and transparency for independent sponsor transactions. Stonington believes this continued institutionalization of the independent sponsor market will create greater risk-adjusted, return opportunities for institutional investors in what is otherwise regarded as a frothy market environment.

Why Lower Mid-Market Healthcare M&A is Poised for Growth

– Dana Pawlicki (As seen in Mergers & Acquistions magazine May 2018)

It is without question that the private equity healthcare sector is storming into 2018. Extremely robust deal activity continues from 2017’s momentum in all size levels of the market, ranging from the lower middle market to large buyout. Driven by healthy valuations in the public markets and funds flush with new capital, Stonington Capital Advisors fully expects these forces to continue to drive frenzied deal activity through 2018. Healthcare generally has returned to being the highest returning sector of the broader market (one only need look at United Health Group’s share price to evidence the sector’s recent success on the large public company level), and after a few years of relative softness, biotechnology has bounced back in a big way. According to the McKinsey Global Institute; “Healthcare has led all sectors in total returns to shareholders; with returns of 15% annualized over the period of 2010-2015, which would suggest this is a long-term trend. While biotechnology remains the strongest sub-sector, the market outside of biotech has also created more consistent value for investors as of late, with successful deals in payors, IT, medical devices, and general services opportunities. There remains one noted sub-sector with weakness in deal volume, as the pharmaceutical space continued its recent trends to record low deal volume for 2017. That said, outside of that area, there are many reasons for continued enthusiasm and activity in healthcare private equity.

Specifically, lower-middle market healthcare continues its run with recent successful fundraises concluding in 2017, including Shore Capital, DW Healthcare Partners, and others. In a fundraising market, where many smaller funds have struggled on their raises, these healthcare specialists have prevailed to continue to grow their capital base. Boston consultant NEPC estimated that there are now approximately “325 healthcare-only firms across the private equity spectrum” (although noting the vast majority of these are more venture focus.) Even within a year of record private equity fundraising ($453 billion, according to Preqin), healthcare specialist firms stood out.

Another very active area of the lower-middle market that Stonington has been involved in has been working with independent sponsors pursuing healthcare deals. The appetite for direct healthcare deal flow has never been stronger amongst institutional investors, as LPs seek to look beyond established private equity firms for access to unique deal flow, and we expect this to continue to be a growing area over the next few years. As healthcare private equity firms continue to grow, and as healthcare private equity sector teams at more generalist firm out-perform, there is bound to more executives seeking to “go it on their own.”Secondly, in the middle market, aside from traditional specialist healthcare firms such as Spanos, Barber, Jesse & Co,. Linden, Riverside, MTS and DW, several larger private equity generalist shops have recently created specific strategies targeting the space such as KKR’s Health Care Strategic Growth Funds. Many of these specialists firms create and pursue niche opportunities within healthcare sub-sectors; growing and consolidating previously fragmented activities.

With respect to the larger end of the private equity market, 2017 witnessed Clayton, Dublier & Rice’s acquisition of Envision Healthcare and TPG’s purchase of Par Pharmaceutical to name a few large private equity transactions. Perhaps most notable was TPG, WCAS and Humana’s taking the lead on 2017’s largest healthcare private equity investment in home healthcare provider Kindred Healthcare in a $4.1 billion take-private deal. It seems home healthcare continues to see strong tailwinds with an aging population looking to stay in their homes. These larger deals further promote activity lowerGo) for $2.8 billion. KKR also executed a successful turnaround of former Pfizer pill manufacturer Capsugel, doubling its money in a sale to strategic Lonza for $5.5 billion. Corporate acquirer INC Research also purchased contract researcher inventive Health for $4.6 billion from Advent International and Thomas H. Lee Partners. Finally, while not a traditional acquisition, 2018 has already brought in an alliance between Amazon, Buffet’s Berkshire Hathaway, and JP Morgan Chase. While early days, given the parties involved, industry experts are viewing this a potential market shift in its creation of an alignment between insurance coverage and healthcare distribution/ access.

Only 2 months into 2018, the momentum with respect to large private equity deals continues. In late February, Cerberus backed grocery chain Albertsons abandoned its IPO plans in favor of acquiring already public Ride Aid. Observers believe this was partly in response to CVS’ nearly $70 billion merger with Aetna. The interesting twist on the CVS deal is that in addition to cost savings on the prescription/insurance reimbursement side, is Aetna’s believe that the chain retailer will become a gateway for additional health insurance customers. Aetna CEO Mark Bertolini recently stated; “Call it 10,000 new front doors to the healthcare system.” Many believe that this deal was also a competitive response to the Amazon, JP Morgan/ Berkshire Hathaway alliance noted above.

Another data-point suggesting the environment continues to bode well for 2018, in a recent survey of 150 CEOs by Capital One, 33% of healthcare chiefs surveyed said their capital needs would be higher in 2018 vs. 2017. Along those lines, the same survey reported that 48% of CEOs anticipated more hiring in 2018 than 2017. This could represent a massive hole to be filled by private equity firms.

Skeptics are quick to correctly point out two clouds in an otherwise bright blue sky. First, the obvious conclusion that all of the activity noted above continues to drive acquisition multiples upwards. That said, private equity firms are looking beyond their basic playbooks to find value. There is little doubt for example that within the roll-up space that by creating platform companies and then buying smaller practices continues to create a multiple arbitrage between the lower and mid to upper segments of the market. PE firms are also getting creative by combining multiple diverse practices under the same payor umbrellas which create additional value from cross-selling and customer convenience. Corporate divestitures also provide a second hunting group where values can be less exuberant, recognizing these transactions can typically take more time to source and execute on. Secondly, while the Affordable Care Act (ACA) looms in the background, there seems to be enough friction on both sides of the aisle, particularly around an area as sensitive as this to many Congressmen’s constituents to keep change from being too radical or cataclysmic. In fact, many private equity firms see potential revisions to ACA as a potential driver of new opportunities and needed capital requirements to fund them.

About Stonington Capital Advisors

Stonington Capital Advisors, LLC is a boutique placement agent with offices in New York, Short Hills, and Atlanta. Stonington advises and raises capital for sub $1 billion private funds in buyout, credit, distressed, venture capital, real estate and non-correlated assets. Stonington also has an active practice of capital raising on direct deals for independent sponsors and sponsors between funds. Within these general sectors, Stonington has also developed a sub-sector specialty within healthcare with numerous private equity, venture capital, independent sponsor and corporate healthcare clients.

Representative Current Stonington Clients Include:

Funds:

• $175 million third generation West Coast U.S. based growth equity fund

• $400 million South Central U.S. based distressed special opportunities fund

• $200 million sixth generation Northeast U.S. based healthcare growth equity fund

• $200 million third generation South Central U.S. based life settlement fund

Direct Deals:

• Capital raise for the acquisition of an automotive distribution business by independent sponsor

• Capital raise for the acquisition and roll-up of specialist medical clinics by independent sponsor

• Capital raise for the proposed acquisition of 3 mid-west manufacturing business by independent sponsor

• Capital raise for the proposed acquisition of 4 U.K. based distressed business in secondary transaction by London

based financial sponsor

• Growth capital for biotherapeutics company with recent $25 million grant from the NIH